Starting in 1980, the Republican Party embraced and implemented "supply-side" economics. The central theory of supply-side economics was politically an easy sell: if the government cuts tax rates – especially on the wealthy – the wealthy will feel more inclined to earn more money. This will encourage the wealthy to make even more money. This will lead to higher tax revenue, which will more than offset the loss of revenue from the initial tax cuts. The central problem is no matter how you look at the results, they didn’t work as advertised.

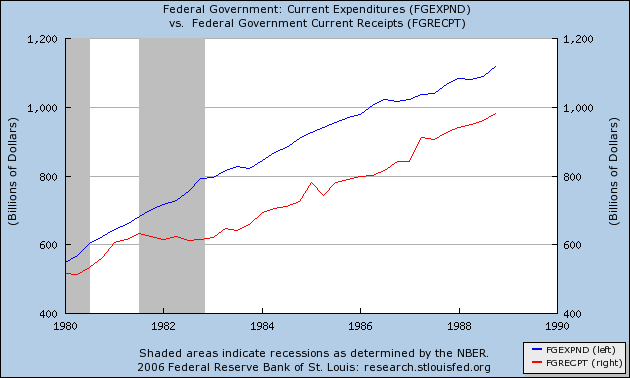

Reagan started the implementation in 1981, cutting upper-income taxes from roughly 70% to 50%. But a funny thing happened. Tax revenues were stagnant for 4 years from 1981 to 1984. For the years 1981-1984, revenues from individual taxpayers were (in billions) $285, $297, $288 and $298,(click on historical budget data) respectively. While the double-dip recession is partially responsible for the first two years, the economy came out of the recession November 1982. Yet for two more years, the rich didn’t feel unencumbered enough to increase their work efforts. At the same time, discretionary spending increased from $307 billion to $379 billion – an increase of 29%. This discrepancy between revenues and receipts then continued for the rest of Reagan’s presidency. Here is a chart from the St. Loius Federal Reserve that shows the discrepancy. Expenditures are blue and receipts are red.

There are a couple problems with Reagan’s overall economic policy. The first is the massive amount of debt he incurred for economic growth (which we’ll get to in a minute). The other problem was the US did not achieve a super-human rate of national product growth. The median quarterly change in GDP during Reagan’s tenure was 3.85%. This is a good rate of growth. But the cost was substantial because to achieve this growth Reagan used debt which the US has not paid off.

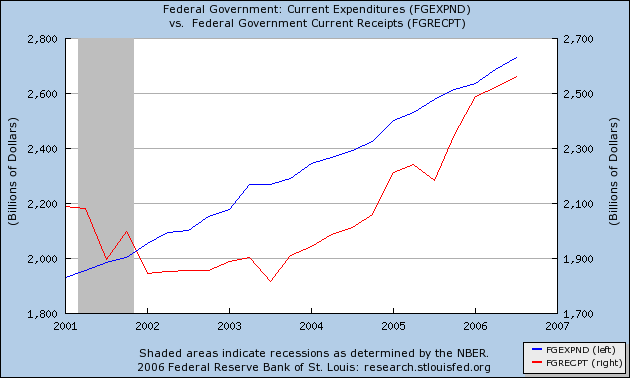

Bush 43 has attempted the same policy with the exact same result. Bush 43 cut taxes twice. Yet revenue from individual taxpayers did not increase sufficiently to make-up for the loss in revenue. Revenue from individual taxpayers was $994 billion in 2001 and $1.08 trillion in the third quarter of 2006. However, Bush 43 has increased discretionary spending from $649 billion in 2001 to $967 billion in 2005. As a result, the gap between federal revenue and spending is similar to Reagan’s graph.

On the chart above, notice the scale for revenue on the right is $100 billion less per line than the expenditure line on the left.

Despite the failings of these policies, Norquist and his tax-cut acolytes refuse to acknowledge that our deficit problem is out of control and primarily their own doing. Even completely gutting domestic discretionary spending would cut the deficit by roughly $500 billion. Supply-side tax cuts created these deficits, the only solution is to raise taxes. No amount of spending cuts in our government will save $2 trillion.